Choosing Health Insurance: The Impact of Pre-Existing Conditions

When selecting health insurance, one major factor to consider is how pre-existing conditions may affect your coverage. Health issues that existed before you apply for insurance can complicate the decision-making process. It’s important to understand how insurance companies view these conditions and what protections are available to ensure you get the right coverage for your needs.

Understanding Pre-Existing Conditions

A pre-existing condition is any health issue diagnosed or treated before you apply for health insurance. Common examples include diabetes, asthma, and heart disease. For many people, these conditions are manageable but may require ongoing care, such as medications, treatments, or regular doctor visits.

Before the Affordable Care Act (ACA), many insurance companies could deny coverage or charge higher premiums to individuals with pre-existing conditions. This made it harder for people to get the care they needed without facing enormous out-of-pocket costs.

How the ACA Changed Coverage Rules

The ACA brought significant changes to health insurance in the U.S. One of the most important provisions is that insurers can no longer deny coverage or charge more based on pre-existing conditions. This change applies to all Marketplace health insurance plans. It has made it easier for millions of people to find affordable insurance that covers their essential healthcare needs.

Under the ACA, health plans must cover pre-existing conditions from the first day of coverage. This means if you need care for your condition, you won’t have to wait for coverage to start, nor will you face higher costs just because of your health history.

Comparing Insurance Options

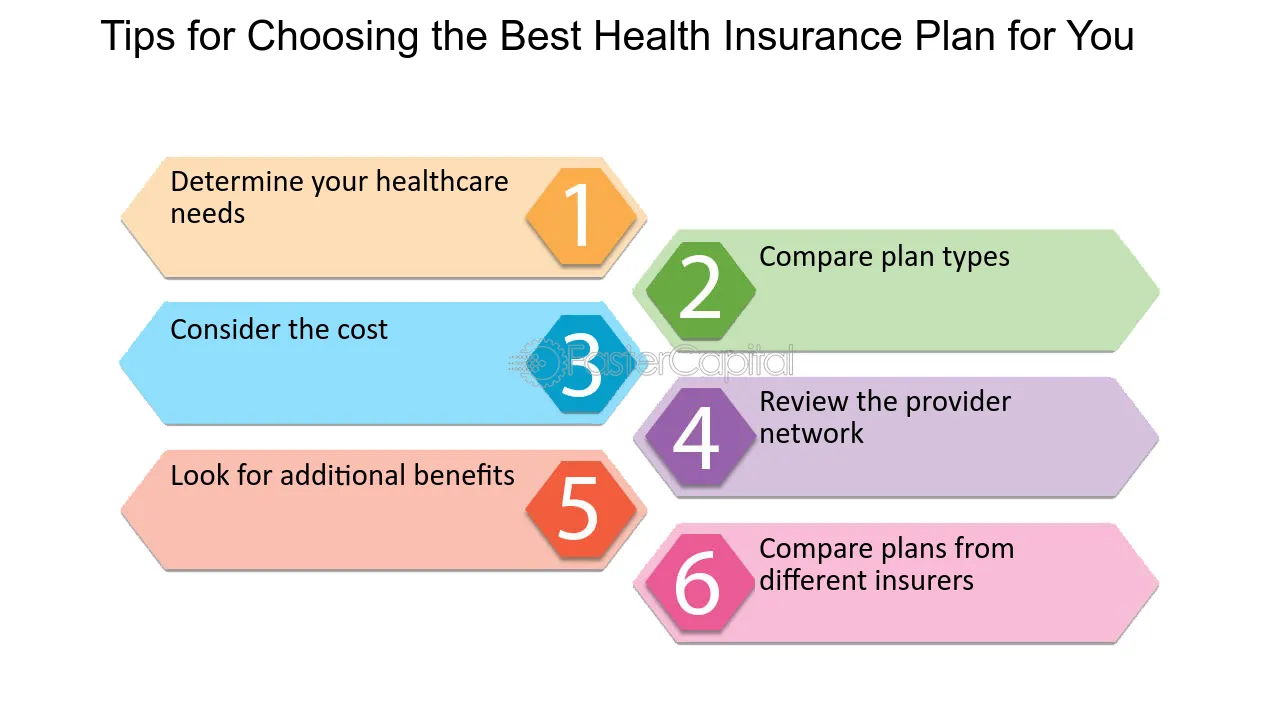

When choosing a health insurance plan, it’s crucial to compare your options carefully, especially if you have a pre-existing condition. Start by reviewing what each plan covers, including doctor visits, specialist care, and prescriptions. Look at the out-of-pocket costs like co-pays, deductibles, and premiums.

Some plans may have better coverage for the medications or treatments you need regularly. Others might have lower overall costs but more restrictions on where and how you receive care. Be sure to check the network of doctors and hospitals to make sure your preferred providers are included.

The Importance of Preventive Care

Many Marketplace health insurance plans cover preventive services without extra costs. This is important for those with pre-existing conditions. Preventive care, such as screenings and regular checkups, helps catch issues early and manage your health more effectively. Keeping up with preventive care can reduce the chances of needing more costly treatments later.

Read Also: The Surprising Growth of Zach Bryan Net Worth in 2024

Choosing the Right Plan

Choosing the right health insurance plan can be overwhelming. If you have a pre-existing condition, take the time to weigh your options. Look beyond the monthly premium and consider what your total healthcare costs might be, including prescription drugs, doctor visits, and any treatments you may need.

If you’re unsure about what plan is best, don’t hesitate to seek help from licensed insurance agents or use online resources that can guide you through the selection process.

Conclusion

Pre-existing conditions no longer have to limit your access to health insurance. With the protections under the ACA, you can find a plan that meets your needs and provides the coverage required for ongoing care. Always compare your options and consider all factors, including preventive care and total costs, before making a decision.